Market Structures

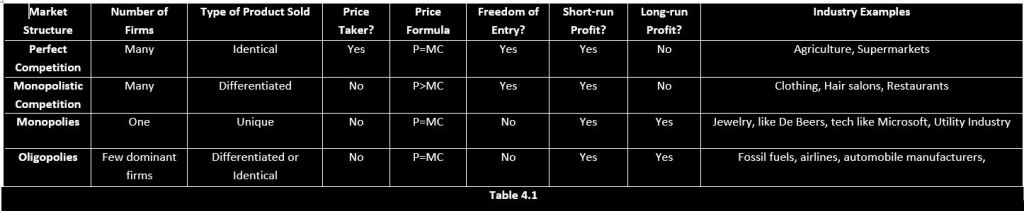

There are four major market structures Perfect competition, Monopolistic Competition, Monopolies, and Oligopolies. First, we will talk about how and why monopolies and monopolistic competition create market inefficiencies and what those are. Secondly, illustrates how an oligopolistic market sets its prices. Lastly, Explain the chart of Different market structures and how each of them determines profitability.

Monopolies fail to maximize total economic well-being because they directly influence the price and quantity produced. Therefore, economic efficiency has failed and the equilibrium is unachievable. Creating DeadWeight Losses which are inefficiencies derived from monopolies caused by the unnatural flow between goods and consumption. “Due to this, products are either overvalued or undervalued. (Team, n.d.)” Second, we have Price Discrimination when a business sells the same goods for different prices to different consumers. When monopolies decide to change prices they usually do it based on the consumers’ willingness to pay, this is how we get Price Discrimination. A wealthier community is more willing to pay the higher prices but a poorer community is not, not only because they cannot but because they don’t value it the same way this is called Consumer Value. There are two types of inefficiencies derived from Monopolistic Competition; Excess Capacities and Markup over Marginal Cost. Excess Capacities produce more than the company needs; this is more profitable for a Monopolistic Competition to continue production because they can lower the average total cost of production by selling the excess for the same price. Markup over Marginal Cost is when a Monopolistic Competition firm’s Marginal Cost is below the Average total cost. This allows the price to equal the Average Total Cost because the price is above the marginal cost. Thus, is caused by the market power a Monopolistic Competitive firm holds.

At first, when playing the Game Simulation Price Discrimination, I wasn’t quite sure how the process worked even though I read the directions and watched the video. In my first attempt of all four rounds, I wasn’t sure how to go about playing the game so I thought about the many parts of manufacturing and selling a product and how I would go about doing that. How that would work if I were to be doing the simulation in real life. In the simulation, I was selling flats of medicine, there were marginal costs, market prices, and quantity of flats with my willingness to sell. As seen in Figure 4.2 in the first round, I was a Single Market selling to consumers. I had one fee, marginal cost which was always 2 dollars. In the second round called Mixed Market, I found that the more I sold, the more profit I made. But once I got into the last two rounds called “Price Discrimination” I had to think about how many flats to sell per company based on price and marginal cost. What I noticed was the less I sold from each the less of a profit I made. While figuring out the price discrimination ratio for the businesses I went up in quantities of 2 which provided a noticeable difference, this allowed me to better understand the system. Selling at a 3 to 2 ratio. Three flats at a high price to two flats at a low price brought a lot of profit because selling more quantity at a higher price brings in high profit from the more fortunate or from consumers who feel it’s worth that much. But, at the same time, supplying at a lower cost for the less fortunate yields higher profits because we are now supplying the entire market.

A very basic form of an Oligopoly where only two firms are involved in the market is called a duopoly. Oligopolies are price setters in an oligopoly market structure, where a small number of sellers produce similar or identical products. That can lead these Firms in this structure to collude in a manner comparable to a monopolistic one. This is when oligopolies are in a cartel, but this is rare because each Business only cares for itself, therefore each business wants to make the most money and usually cannot come to a compromise for them to have the benefits of a monopolist market. There are a few ways in which an oligopoly can set prices either by Price Wars or Collusion. One way of colluding is being in a cartel where all companies agree upon prices and production. Another is having a leadership of one firm, which is the approach for firms to follow a recognized leader who sets the price and production. So, when the leader’s prices change, the followers’ prices change. These price-setting tactics can lead Oligopolies to reach the Nash equilibrium state when costs and benefits are balanced, incentivizing firms from leaving the market. While ousting the sharks with the use of Market conditions, Contracts, Collusion, and Government laws. Government laws such as the Anti-trust laws, the Sherman Act of 1890, and the Clayton Act of 1914 were early attempts to control the growth of monopolies. These acts help to curb companies from acting with the purposeful intent to cut out the competition using cutthroat pricing and exclusive contracts. The Sherman Act only made Monopolies illegal, it didn’t set any guidelines for what the businesses did to be an illegal monopoly. Not until the Clayton Act of 1914, that’s when the government decided that acting with purposeful intent to cut out the competition of other businesses by using methods of unethical behaviors was illegal. Price Wars is just what it sounds like, a battle between all the businesses in the market, each setting prices to see who can get the most money from the highest number of consumers. “Cournot competition is an economic model in which competing firms choose a quantity to produce independently and simultaneously. The model applies when firms produce identical or standardized goods and it is assumed they cannot collude or form a cartel.” (Liberto, 2021)

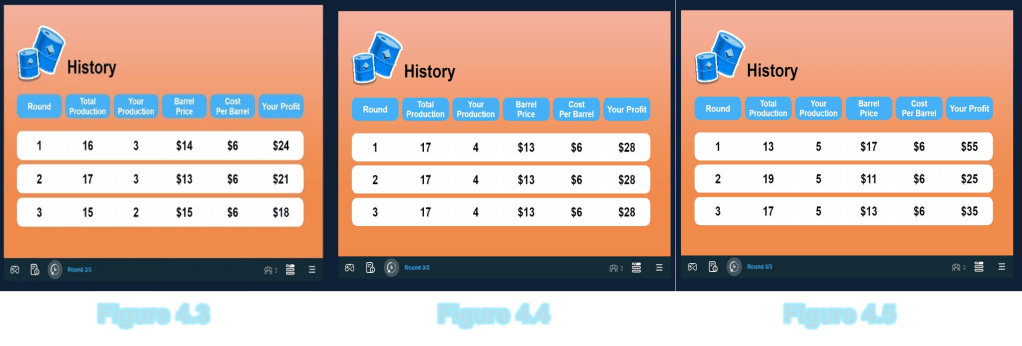

In the simulation game Cournot, I was playing as a firm in the Oil Market, there were always 3 firms, with a maximum production of 10 barrels per firm, and a price per barrel. Our profit depended on the change in market price per barrel, which changed based on the total market production of barrels. Barrel cost never changed at $6 per barrel. In Attempt One I kept my production at the low end to see how much the other companies would produce once I got a general understanding of where they would be producing. In Attempt Two I increased my production by 1 from 3 to 4 barrels. Shown by Figures 4.3 and 4.4. This helped me to see that I could potentially double my profit at a lower barrel price just by a few dollars when total production is higher compared to lower. When I continued to Attempt Three (Figure 4.5), I realized if the total production is low and the barrel price is high I make double the money when producing 5 barrels than 4 at high total production and low barrel price. This showed me that understanding the market and inferencing my competitors’ production rate, What goes up must come down, and the opposite is true when talking about the movement along the demand curve.

Sense market structure properties determine profitability, each different market gets to profitability in its own way if it even gets there. Both Monopolies and Monopolistic Competitive Firms are profitable by being price makers and controlling their market by simply being differentiated or unique in their products. A Monopoly has barriers to entry, one, is owning a key resource for its product or is its product, this happens by “government intervention of providing a firm with exclusive rights to sell a good or service” (Mankiw, 2021) using a patent or copyright. However, a Natural Monopoly can evolve into a Competitive Market by market size expansion from one independent dominant firm to multiple. A Perfectly Competitive Market doesn’t influence price, it is based solely on Market conditions and because natural market conditions push for an equilibrium, so, their prices are equal to marginal cost. So, when there is a Monopolistic Competitive Market, there are a larger number of firms that have similar products, but not the same, who sell at their price based on what other companies in this market are doing. This makes being a monopoly in the short run profitable but in the long run not profitable due to the number of firms entering the market and causing profit to become zero. However, this doesn’t last long because some firms will drop out of the race allowing the firms who stayed in to start making profit again. Oligopolies are a few dominant firms with identical or differentiated products making it hard for other firms to enter the market because of this they do not rely on the market for pricing they are price makers which allows them to make money in both the long run and short run. Monopolies are similar to oligopolies in every way except for the two major differences. Such as the number of firms, and type of product sold. Monopolies only has one firm that is dominating the market by producing a unique product. This unique product is how they can charge anything they want making their prices equal to their Marginal Cost allowing them to make the most profit.

References

Mankiw, N. G. (2021). Principles of microeconomics (#9 edition). Cengage.

Majaski, C. (2023, November 3). Consumer Surplus vs. Economic Surplus: What’s the Difference? Investopedia. https://www.investopedia.com/ask/answers/041715/what-difference-between-consumer-surplus-and-economic-surplus.asp

Team, W. (n.d.). Deadweight Loss. WallStreetMojo. Retrieved November 30, 2023, from

Leave a comment